12J investment vehicle pursues ‘conscious capitalism’

Secha Capital VCC offers SMEs growth, impact capital. Vote in the poll.

read more

Acquire a portfolio of newly developed lodges in Dunkeld Estate and provide industry-leading hospitality assets to the public.

Dunkeld Corporate Investors Collection is an authorised Financial Services Provider (FSP#48776) and an approved Section 12J Venture Capital Company (VCC#0078)

R200 000.00

16%-20% p.a. IRR

5-7 Years

R50 million

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Fusce vitae risus nec dui venenatis dignissim. Aenean vitae metus in augue pretium ultrices. Duis dictum eget dolor vel blandit.

Reach out to us to learn more about the Dunkeld 12J Collection Hospitality opportunity.

We will provide you with an overview of Section 12J and explain the Dunkeld 12J Collection Hospitality investment.

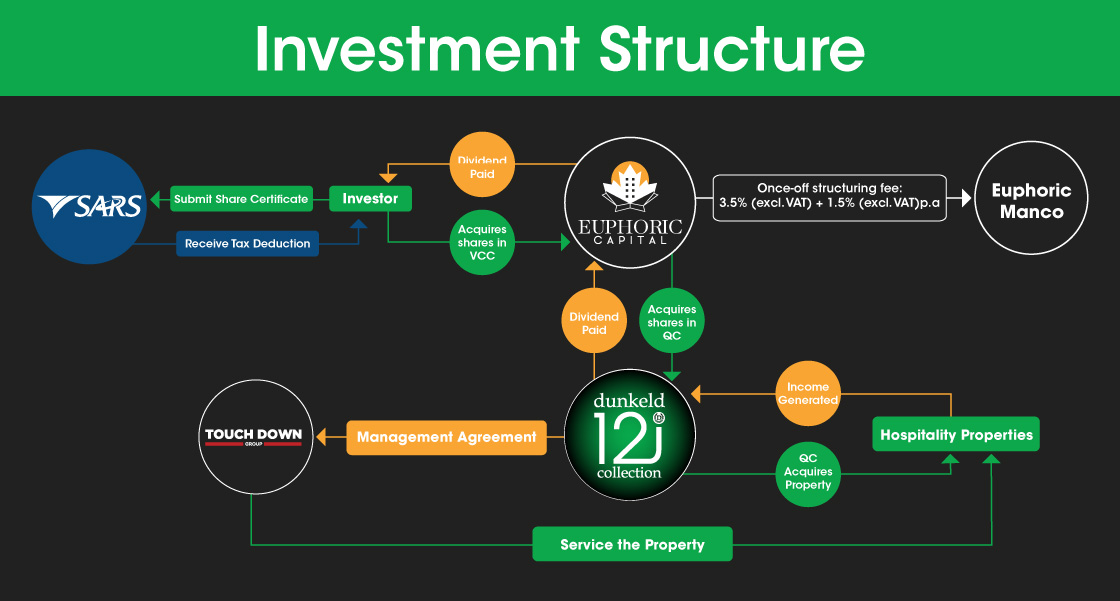

Once you have decided to invest, you will subscribe for shares in Euphoric Capital and be issued a share certificate in the VCC. Your funds will then be directed into Dunkeld 12J Collection Hospitality.

When you file your annual or provisional tax return, you simply attach a copy of your VCC share certificate to claim your tax-deduction. In order for the tax-deduction to remain permanent, investors must hold their shares for a minimum of 5 years.

Profits generated in Dunkeld 12J Collection will be distributed to investors as a dividend.

Investors can indicate their desire to exit after 5 years and Dunkeld 12J Collection Hospitality will begin selling assets and buying back shares from Year 6.

Section 12J is a tax incentive that was introduced by Treasury to encourage South African tax-payers to invest into various sectors within the South African economy and receive a 100% tax-deduction on their investment. The South African Tourism sector has been identified by South African government as a priority sector for employment opportunities and economic growth. According the the World Travel and Tourism Council, in 2018, the total contribution of Travel and Tourism to South Africa’s GDP was estimated at R412.5 billion and is forecast to grow to R598.6 billion by 2028.

Euphoric Capital is a registered and approved Section 12J VCC that allows South African tax-payers to invest into various hospitality opportunities and receive a 100% tax-deduction on their investment. The returns seen in this sector coupled with Euphoric Capital industry knowledge and the Section 12J tax deduction are set to provide investors with enhanced returns throughout the investment period. As an investor in Euphoric Capital, you can take comfort in the fact that you are positively contributing to the growth of the tourism industry and creating employment opportunities in the process.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Fusce vitae risus nec dui venenatis dignissim. Aenean vitae metus in augue pretium ultrices. Duis dictum eget dolor vel blandit.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Fusce vitae risus nec dui venenatis dignissim. Aenean vitae metus in augue pretium ultrices. Duis dictum eget dolor vel blandit.

Unit F 001 Ground Floor Lincolnwood Office Park Woodlands Drive Woodmead

Dean : +27 79 494 5525

dean@euphoriccapital.co.za

Mon - Fri: 08.00 - 16.00